THIS MATERIAL IS A MARKETING COMMUNICATION.

The Next Giant in Biotech

Biotechnology is the science and business of using biological materials, such as proteins, antibodies, genes, and cells, to develop new drugs and treatments.

Humans have been harnessing the power of organisms for thousands of years – bread-making is an early example – but recent advances in genome sequencing and bioinformatics have revolutionized our understanding of biosciences. They may present the first legitimate possibility of treating illnesses once thought of as incurable or fatal.

Genetic mutation is an example of biotechnology. The World Health Organization estimates that mutations in a single gene are responsible for over 10,000 different human diseases1; this is likely to be the first time it can be treated through genomics.

Chinese Biotech Boom

In China, the healthcare market remains highly underpenetrated in comparison with global peers. However, with an aging population, rising affluence, and the incidence of non-communicable diseases like cancer and diabetes well above the world average, it is on the cusp of enormous growth.

Grand View Research forecasts that the global genomics market will be worth about USD22 billion by 2020, with a growth rate of 10% a year. In China, biotech accounts for only 12% of the country’s total drug market, compared with the global average of 25%. Yet the country already has the second-largest genomics market (and second-largest pharmaceuticals market) in the world. It is set to overtake the US to become the most significant player in the next few years.

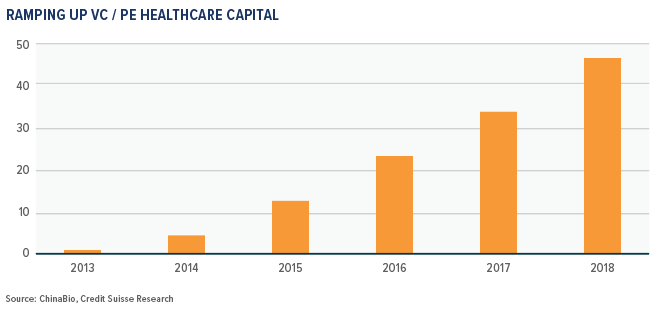

Frost & Sullivan estimates that China will have the world’s fastest-growing biotech industry by 2021, with an annual expansion rate of 16.4% over the next five years. In 2017, the total value of domestic and international Chinese biotech initial public offerings reached a record of USD2.8 billion. Venture capital and private equity investment in Healthcare had also been ramping up quickly. Healthcare capital investment grew at a CAGR of 132% between 2013 and 2017, while domestic venture capital investment reached a record of USD17.4 billion in the biotech sector in 2018.

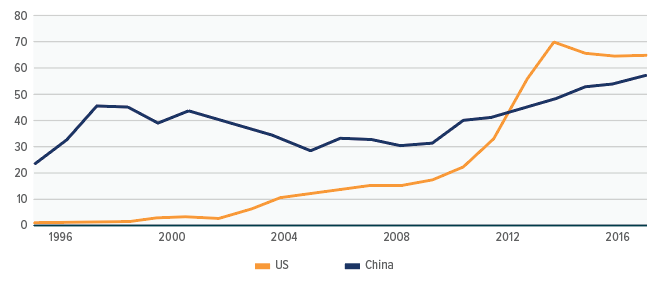

NUMBER OF PATENTS

RAMPING UP VC/PE HEALTHCARE CAPITAL

Be Local, Go Global

In the longer-term, China’s biotech business has the potential to go global, either by out-licensing molecules to overseas markets or by developing assets in the US, EU, and elsewhere. In 2018, Chinese biotech companies made 164 cross-border licensing deals, more than double the 2013 figure, according to China Bio2. China is currently pursuing trials for one-quarter of its innovative assets overseas.

The country’s increasing dominance is reflected in the number of biotechnology patents granted, rising from 1,000+ to 6,000+ in 2006 – 2016, with a percentage increment from 12% to 27%. In 2012, China even surpassed the US in this area.

China’s government has listed biotechnology as one of the ten critical sectors for development under its “Made in China 2025” industrial strategy. To support the development of the industry, the government is improving the country’s regulatory framework, reforming the drug-approval process, and providing precise guidance for biosimilar developers.

There are risks, of course. The sector requires substantial investment in R&D, and those investments are not guaranteed to lead to commercially successful products. A promising company’s prospects are also vulnerable to changes in the regulatory environment, intensifying competition, and the rapidly evolving nature of technological progress.

Intellectual property remains a concern, too. Many biotech companies are dependent on the ability to use and enforce intellectual property rights and patents. Even if enforcement is effective, the expiry of rights and patents can have an adverse financial consequence for those companies.

Investors can gain exposure to early-stage biotech innovation in the sector via private equity, new IPOs, recently listed Chinese biotech companies on domestic and overseas stock exchanges, and through legacy Chinese pharmaceutical companies moving into biologics.

Your Gateway

The Global X China Biotech ETF offers a broad and diversified exposure to the strong favorable tailwinds of this fast-growing area. The fund features biotech companies that may benefit from the ‘Made in China 2025’ strategy, which has identified the industry as a key sector for development. As a pioneering offering in this space, this could be an early opportunity to capitalize on what we see as a promising disruptive trend in the Chinese economy.

1 World Health Organisation, accessed on Sep 2019.

2 Financial Times, as of 25 Jun 2019.

Disclaimer

This document contains the opinions of Mirae Asset Global Investments (HK) Limited (“MAGIHK”) and is intended for your use only.

It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument and shall not constitute any form of regulated financial advice, legal, tax or other regulated service. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. MAGIHK makes no representation as to their accuracy or completeness and therefore do not accept any liability for a loss arising from the use of this document.

All Investments contain risks. Forecasts, past information and estimates have certain inherent limitations. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these opinions are suitable for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Past performance is not a guarantee or a reliable indicator of future results. Before making any investment decision, investors should read the applicable fund prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the applicable investment and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice if in doubt.

This document is issued by MAGIHK (Licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance). This document has not been reviewed by the Securities and Futures Commission and no part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of MAGI HK.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.