THIS MATERIAL IS A MARKETING COMMUNICATION.

Introduction to Hardware OEM

This article will provide a brief introduction of the original equipment manufacturer and discuss the current competitive landscape.

History of Hardware OEM

Original Equipment Manufacturer (OEM) in the context of electronic manufacturing services is a company that produces parts and equipment for another company. The product cycle of electronics shrank rapidly over the years; from 10-12 years in the 1950s to around 6-18 months today. It is difficult for hardware brands to manage all manufacturing in-house and by outsourcing the hardware manufacturing process, electronic terminal companies are able to focus on product development, sales and marketing, etc. The burden of capital expenditure is also shared by OEMs and other upstream component makers, providing more agility in capacity expansion. Japan and Korea have developed strong electronic manufacturing capabilities after World War II, while Taiwan became a key personal computer (PC) OEM partner globally in the 90s.

Taiwanese OEM Dominance

As personal computers and other consumer electronics took off in the 1990s, Taiwanese OEMs emerged as a key supplier due to their strengths in a few key areas. The first factor is speed. Companies like Hon Hai are able to speed up the development process with a global R&D network. Delivering molds and tools for a new production line within days compared to weeks of other global competitors at the time. Dedicated teams ensure products clear customs and ships as soon as possible. The speed has been crucial for brand customers to shorten their product cycle and improve inventory management. Second, a strict labor management system was implemented to maintain a cost advantage. Taiwanese OEMs were known for having military-style management, with strict discipline and clear task allocation results in a high efficiency environment. Third, strong execution and quality control at the production line.

New OEM Players Challenging the Competitive Landscape

Traditional OEM players usually focus on the final stages of assembly in the manufacturing process, with some in-house component supply. On the other hand, upstream component makers usually focus on R&D and manufacturing of specific parts as assembly businesses require a different set of capabilities. Assembly business is labor-intensive and requires a strong capability to manage labor seasonality and component inventory. The new group of OEM players has emerged in recent years not only copying the strengths of the Taiwanese OEM companies but with an even higher level of vertical integration, providing both assembly, component services and even system packaging.

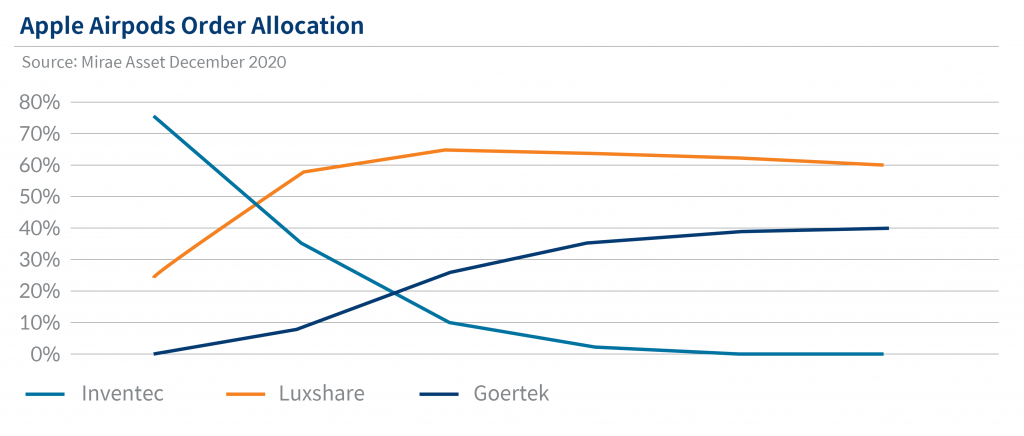

New players are also willing to take on more risks and invest with brand partners. In the case of Apple Airpods, Inventec was the OEM which worked with Apple for multiple years launching the first-generation AirPods. However, at the time AirPods assembly margin was low for Inventec and management project volume was small for the product. Consequently, the company was not willing to invest in additional production lines while companies like Luxshare and Goertek were willing to take the risk with Apple to expand its capacity on aggressive shipment projections. They are also investing heavily in R&D to expand their capability in order to supply more components in AirPods.

This results in a higher margin profile, Return on Equity (ROE) and profitability compared to traditional OEMs, brand customers also see the benefit of vertical integration with better cost-saving and efficiency. As a result, companies like Luxshare, Goertek, BYDE are gaining market share from traditional OEM players like Foxconn, Compal, Inventec, Pegatron, etc.

Competitive Landscape Change

Chinese OEMs are gaining order share in the assembly of various Apple products, as we see Apple allocating more assembly order share to vertically integrated OEMs in new product categories such as the Airpods. Chinese OEMs are also gaining momentum in existing product categories such as iPhones, iPads and Apple watches. We see a trend of consolidation in the industry as Chinese OEMs make a strategic move to further enhance their level of vertical integration. Key acquisitions this year include Lens tech acquisition of catcher’s smartphone casing business, and Luxshare’s acquisition of Wistron’s China iPhone EMS factories. OEMs are evolving from the traditional, limited role of assembly into increasing vertical integration, product R&D, and labor management capabilities. The new generation of OEMs aims to provide more services at a more cost-efficient price.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.