THIS MATERIAL IS A MARKETING COMMUNICATION.

Huawei: the Cradle of China Semiconductor Manufacturing, but not all

The US sanction on Huawei has revealed the rapid development of China’s semiconductor chip design business. We will discuss the latest status of China’s semiconductor chip industry in a series of reports.

Huawei Paving the Way

Huawei has played a vital role in leading the development of China’s semiconductor industry. It is able to penetrate into the highest value-added segment of the semiconductor industry which is chip design and compete with the top fabless companies in the most advanced chips like the smartphone system on a chip (SoC).

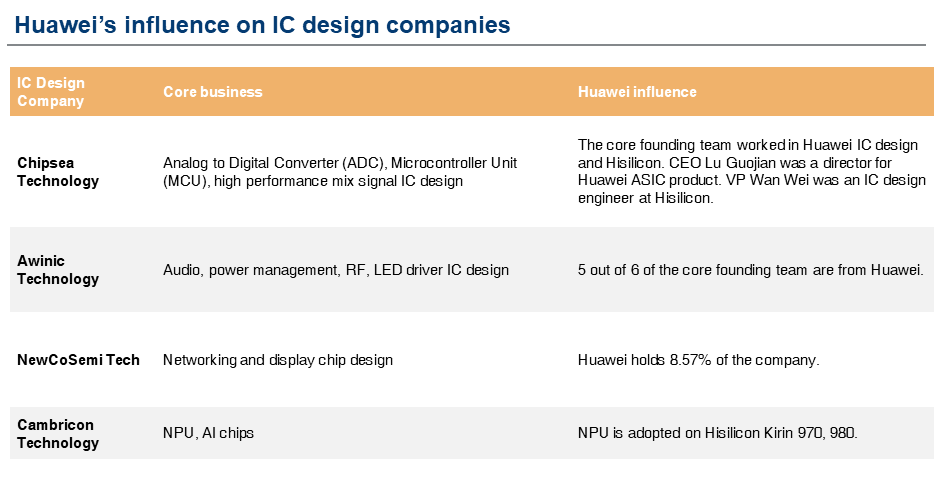

We see two key positive impacts Huawei has on China’s semiconductor industry. First, the quick growth of Hisilicon creates jobs for chip design as the company hires and trains many IC design engineers which enlarge the talent pool in China. Hisilicon hires around 7,000 staff globally, the majority of whom are located in China and headquartered in Shenzhen1. Huawei also has a large research institution called the 2012 lab (more details below). Second, Huawei has strong bargaining power in the semiconductor supply chain, which puts it in a position to support domestic companies. There are two layers of this dominant position. Huawei is a top tier terminal maker in smartphone and telecom equipment, so this allows the company to use domestic IC solution when it is available. In addition, Hisilicon has the industry’s leading design which generates large orders. It had around 13% market share in smartphone SoC in FY192. Huawei can allocate orders to support the domestic semiconductor supply chain. Semiconductor Manufacturing International Corporation (SMIC), for example, had around 17% of sales from Huawei in FY193, producing various Hisilicon–designed chips.

Huawei Hisilicon is one of the earliest customers of Cambricon Technology, a leading Artificial Intelligence (AI) chip design startup in China. Hisilicon adopted the Network Processing Unit (NPU) design of Cambricon in their Kirin 970, 980 SoC, and this brought much-needed revenue to Cambricon. In FY17 and FY18, Huawei accounted for over 97% of Cambricon’s full-year revenue4.

Huawei 2012 Lab

2012 lab is the research laboratory of Huawei which covers the majority of Huawei’s business line. It has 16 institutions globally, eight in China, and eight overseas. Under the 2012 lab there are many other labs such as Noah’s Ark Lab which focuses on AI research. The lab actively hires graduates in China which we think is important for talent training. The current Hisilicon president He Ting Bo joined Huawei in 1996. She is a home-grown talent who worked for and is now head of the 2012 lab.

Noah’s Ark Lab

The Noah’s Ark Lab is the AI research center for Huawei founded in 2012, located in Hong Kong, Shenzhen, Beijing, Shanghai, Xi’an, London, Paris, Toronto, Montreal, and Edmonton. Research areas of the lab mainly include computer vision, natural language processing, search & recommendation, decision and reasoning, and AI theories.

Research areas of Noah’s Ark Lab are as below:-

- Computer Vision. R&D in core vision algorithms and platform design. Applications include surveillance, smartphone camera, autonomous driving, etc.

- Natural Language Processing (NLP). Development of NLP algorithms for voice recognition, translation, knowledge graph, and natural language dialogue.

- Search & Recommendation. Developing recommendation systems and search engines.

- Decision and Reasoning. Supporting Huawei business and improving supply chain management through research in anomaly prediction, and deep reinforcement learning. The application includes optimizing power management of the base station, etc.

- Others. Research in fundamental learning algorithms and theories, exploring possible industrial applications.

Other Chinese Tech Giants Moving into the Chip Business

Besides Huawei, other domestic technology companies are also making a move into the semiconductor business through in-house team and investment. We are positive about the outlook of China’s semiconductor industry, as we see a strong long-term commitment for domestic companies to develop and invest in this area. Tencent is a major investor in the AI chip startup Enflame, and established its IC design subsidiary this year. Baidu built an in-house IC design team and launched its Kunlun AI chips at the end of 2019. Oppo also established a team recently to develop in-house smartphone chips.

Alibaba – Pingtouge

Alibaba acquired Hangzhou C-SKY Microsystems in 2018. The company was founded in 2001 as an integrated circuit design house dedicated to 32-bit high-performance low-power embedded CPU and chip architecture license based on RSIC-V architecture. Initial applications include industrial, network and communication, Internet of things (IoT), and auto.

In September 2018 Alibaba announced the formation of Pingtouge Semiconductor Limited Company, which is largely based on the acquired team from C-SKY Microsystem, combined with existing talents from DAMO Academy. Alibaba reportedly hired talents from Advanced Micro Devices (ADM), ARM Limited, Nvidia Corporation, and Intel for chip design at the DAMO Academy.

Pingtouge’s products are as below:-

- Hanguang 800 – AI Inference Chip: The company’s first product, an AI inference chip which claims to have industry-leading performance. It is an Application-specific integrated circuit (ASIC) chip based on RISC-V architecture, likely to have used 7nm node at Taiwan Semiconductor Manufacturing (TSMC).

- Xuantie CPU – IoT CPU: Xuantie CPU series are RISC-V architecture based CPU. The Xuantie series is designed for IoT and AI applications doing an on-device calculation. The chip is likely to use a 12nm node. It is worth mentioning that Huami also developed its own AI chip based on ARM architecture for its wearable products, and therefore we think the barrier in this area is not too high.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.