THIS MATERIAL IS A MARKETING COMMUNICATION.

Why the South China Economy Matters to the Construction Materials Sector

When investors think of China, many consider the world’s second-largest economy as a single market. However, each region holds its unique business dynamics and cycles. South China, otherwise known as the Greater Bay Area, is thought of as one of the most promising regions in China and offers distinctive investment opportunities with its own characteristics.

The Greater Bay Area has become one of the most promising regions in China after a series of supporting policies, coupled with a healthy bottom-up private entrepreneurial environment. For example, the Guangdong province has the largest base population as well as population inflow, and holds the largest net population change above other provinces, which shows great growth potential in the future.

In our view, the development of the Greater Bay Area is a longer-term plan by the Chinese government to integrate Guangdong, Hong Kong and Macau, in addition to plans to build up more “super centres” after Beijing and Shanghai. As a result, the Greater Bay Area could attract a steady supply of younger workers that could bring higher productivity to the region—similar to Beijing in the 90s.

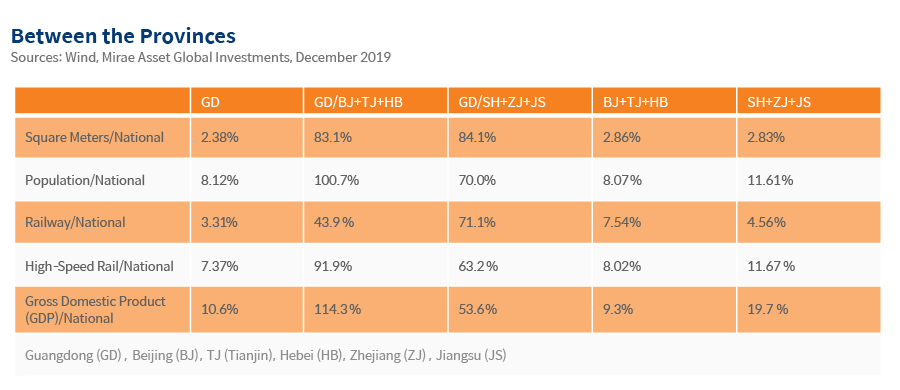

Naturally, this has supported demand for housing in South China. We also think it could boost infrastructure in areas such as Guangdong and Guangxi in the coming years. Counterintuitively, South China is generally lagging other regions in infrastructure, especially within the Guangdong province. Guangdong has almost the same level of land area as Beijing-Tianjin-Hebei and Shanghai-Zhejiang-Jiangsu. However, the railway length is just 44% of Beijing-Tianjin-Hebei and 71% of Shanghai-Zhejiang-Jiangsu, with the high-speed rail (HSR), just 92% and 63% respectively.1

This suggests to us that there is room for improvement for Guangdong’s infrastructure, and with it, potential investment opportunities within this sector. Guangdong is one of the richest provinces in China with lower than average debt to gross domestic product (GDP) and debt to total income2—it is largely expected that these projects will yield returns due to demand.

Following China Railway’s guidance, 38,000km of national HSR is set to be completed by 2025 and 45,000km by 2030.3 Guangdong announced it would accelerate HSR construction, especially in the remote north and western part of the province.4 Meanwhile, the Guangxi government has also announced it would implement policies to support rural and transportation infrastructure over a two-year period (2019-2021), as part of a wider movement to support and feed into the Greater Bay Area.5

Real estate and infrastructure are commonly considered as crucial elements in downstream demand for construction materials. For instance, it takes roughly 400kg-500kg of cement for one square meter of residential construction according to industry experts. Provinces such as Guangdong, which reported over 160 million tons in cement sales in FY18, are prime examples of how a lack of current infrastructure will likely drive demand for construction materials.6 With many new industries moving to Guangdong, in addition to attracting a young demographic, it is likely that we’ll see a sustained demand for cement going forward.

Staying Ahead with Mirae Asset’s Latest Insights

2 Source: HSBC, September 2019.

3 Source: National Development and Reform Commission, November 2017.

4 Source: China Daily, 13 September 2021.

5 Source: The State Council, the People’s Republic of China, September 2021.

6 Source: Digital Cement, November 2019.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus. This document has been approved for issue in the United Kingdom by Mirae Asset Global Investments (UK) Ltd, a company incorporated in England & Wales with registered number 06044802, and having its registered office at 4th Floor, 4-6 Royal Exchange Buildings, London EC3V 3NL, United Kingdom. Mirae Asset Global Investments (UK) Ltd. is authorised and regulated by the Financial Conduct Authority with firm reference number 467535.

Copyright 2024. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.