THIS MATERIAL IS A MARKETING COMMUNICATION.

China’s Leading Position in Solar Glass and EVA Industry

China is absolutely the leader in solar glass and Ethylene Vinyl Acetate (EVA) film manufacturing. The top five Chinese solar glass producers took up a total market share of 68.5% in terms of capacity by the end of 20191, while the top Chinese EVA filmmaker took up nearly 60% of the global market share2. In this article, we would like to see what has been going on in solar glass and EVA industries in the last years and explore why Chinese players are able to consolidate the markets. We try to answer if the current leading players will keep the competitive advantages in the future and under what kind of conditions.

Development in the Last 15 Years

Solar glass is one of the important parts of the module that is used to protect solar cells inside. German companies first adopted glass on passive solar houses dating back to the 1930s, followed by the United States, UK, Japan, and France. Before 2006, the top four solar glassmakers were Pilkington Glass Company in Britain (acquired by NSG later), Saint Gobain in France, AGC and NSG (Nippon Sheet Glass) both in Japan which started the business from architectural glass or automotive glass with higher added value and accordingly higher margin. The top four glass makers only had limited capacities for solar glass, and as a result, asked for relatively higher prices. Global solar glass price had hiked to CNY80 per square meter before 20063.

As the solar market switched from Europe to China between 2008 and 2012, Chinese glassmakers, such as Flat Glass, Xinyi Glass (which spun off the solar glass business later into Xinyi Solar) and others entered into the solar glass industry successively. The key difference of solar glass compared to standard clear glass is that the former is manufactured with lower iron content and produces a much clearer glass structure with no green tint visible through the glass. It has a higher light transmittance of over 90% vs 83% for regular glass, which as a result increases the module conversion rate.

There are five inputs to produce solar glass: soda ash, quartzite ore, power (natural gas, heavy oil and electricity), equipment and labor. Citing Flat Glass’s cost structure4, soda ash and quartzite ore accounted for 37% to 41% of the total production cost, while power cost took up 40% to 41% followed by labor cost of 3.8% to 5.5% and the rest attributed to equipment depreciation and amortization and others. The moat located in: 1) technical advantages and operations management to raise production yield rate; 2) good access to funding for the economy of scale; 3) visible stable sales to downstream module customer to reduce the account receivables and inventory holding pressure, thanks to the continuous production process of glass; 4) glass qualifications authority.

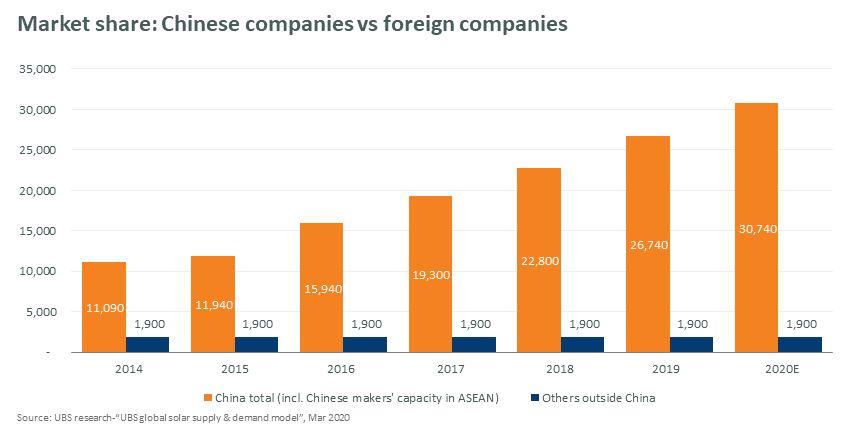

As China becomes the largest module maker in the world and Chinese government proactively supports the industry, solar glass makers benefit in 2) and 3) with a funding-friendly capital market, stable supply chain and less international trade frictions such as tariffs. After Chinese makers self-developed the know-how on lower iron content, they took off in a short period and consolidated over 80% of the global market share by now.

EVA film (Ethylene Vinyl Acetate) is another important part of solar module. EVA film is essentially a thermoset adhesive material that is used to connect the solar cell with backsheet (if there is) and solar glass as shown in Exhibit 1. The key inputs to produce EVA film are EVA resin, power and others (depreciation and amortization, labor), which take up 80%+, 2% and 10%+ respectively5, according to Hangzhou First’s report. The key moat locates in the formula and the according to equipment and production process management. EVA film accounts for around 5%6 of module cost, but is strictly required to maintain good quality for a long time, such as non-yellowing, no delamination or crack since the lifetime of module should be over 25 years. Before 2006, the key producers were Specialized Technology Resources (STR) from the US, Mitsui Chemicals and Bridgestone from Japan, and SKC and Hanwha from Korea. These companies are experienced in petrochemical products, and EVA was a very small part of their product mix with little significance. To cut costs and stabilize supply as well as quality, Suntech Power, the Chinese module leader at that time, spent a lot of time and money preparing a Chinese EVA maker that was called Hangzhou First later. Hangzhou First started its business in the chemical industry. They researched and developed EVA products with Suntech Power, improved the manufacturing method and equipment design based on feedback from Suntech Power. After years of trials and errors, Hangzhou First realized production line self-design and mastered formula know-how, becoming one of the top three EVA providers globally by 2008.

Further Consolidation in the Future

Solar glass and EVA film are typical chemical manufacturing businesses, where technology matters but the innovation is at a slow pace. Companies keep on improving yield rate and cost structure. It is not easy for new entrants to break in, thanks to technological know-how, scale moat, qualification authority, and customer relationship. The competitive landscape hasn’t changed too much in solar glass and EVA film since 2010, which is very different from what has happened to other solar materials.

The top five Chinese solar glass producers took up a total market share of 68.5% in terms of capacity by the end of 20197. As glass production is a continuous process that cannot stop for years, it requires a stable sales channel before building up any capacities. Moreover, it usually takes six months for qualification authority and another six months for a capacity ramp up, which creates huge pressure on cash collection. Therefore, it is not attractive to manufacturers who have no knowledge or customers in the glass industry to enter. Know-how in lower iron content and yield rate and cost advantages from the economy of scale stopped regular glassmakers to some extent, too. Thus, we do not expect big changes in the solar glass competition landscape in the long term unless great innovations in solar panels appear.

Hangzhou first takes up nearly 60% of the global market share, and the top three Chinese EVA makers account for 80%8. Similar to solar glass, qualification authority and module makers’ requirement on stable quality and supply prevent new entrants to the EVA market. The current top players are likely to further consolidate their leading positions in the long term. The only thing we would like to emphasize is EVA resin relies on imports in China. Should any player realize domestic substitute, it may affect the cost significantly, followed by the competitive advantages. However, EVA resin is a petrochemical product. It is believed that it is very challenging for the current EVA makers to integrate into the upstream.

In conclusion, Chinese solar glass and EVA filmmakers have first-mover advantages in scale, qualifications, know-how, and sales channels. They are likely to further consolidate their leading positions in the future unless significant solar technology innovation takes place.

1 UBS research-“UBS global solar supply & demand model”, March 2020

2 Soochow securities report, 22 July 2020

3 Flat glass IPO book

4 Flat glass IPO book

5 Hangzhou First IPO book

6 CLSA research report, 20 July, 2020

7 UBS research-“UBS global solar supply & demand model”, Mar 2020

8 Soochow securities report, 22 July 2020

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.