THIS MATERIAL IS A MARKETING COMMUNICATION.

Trends of Chinese Real Estate : Consolidation

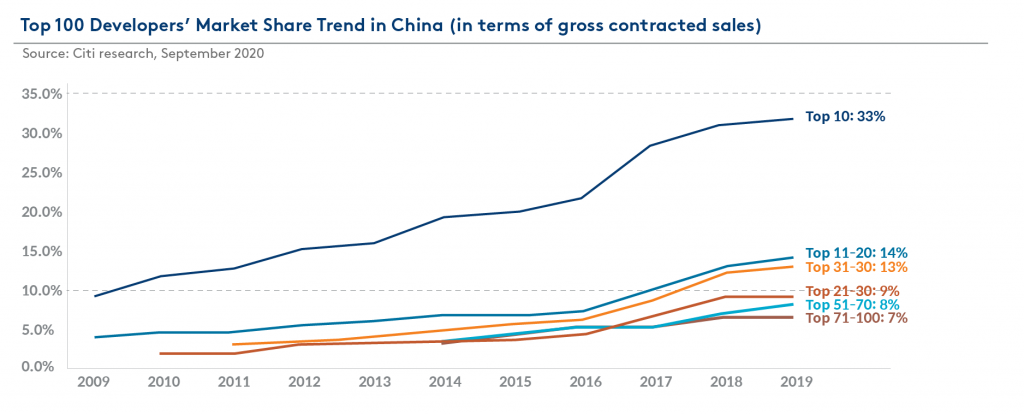

The Chinese real estate industry has enjoyed a golden era in the last twenty years. Leading developers have benefited from both the fast-growing market size as well as increasing market share. We have seen the top 20 developers’ market share increase from 17.0% in 2010 to 46.4%1 in 2019 in terms of gross contracted sales. Quite naturally we may ask the following questions: What was the catalyst behind their gain in market share? Will the trend continue into the future? These are the topics we will address in this article.

How did the top 20 developers’ gain Chinese market share in the past decade?

As shown in Exhibit 1 below, the top 10 developers’ market share in China had continually increased from 12.1% in 2010 to 32.5% in 2019 (gross contracted sales). Meanwhile, the top 20 developers’ went from 17% to 46.4% during the same period. The inflection points occurred in 2014 and 2017 when national sales were decelerating mainly due to the tightening of polices that occurred earlier on. A few of the leading developers completed rapid strategic positioning in top tier cities and were aggressively land banking. They were able to increase the contracted sales shortly after policy turned favourable, while small names were casted out. We saw high growth over 25% year-over-year for Greenland, Evergrande and Sunac in 2014; over 40% for Vanke, Evergrande, Poly, Longfor and Sunac in 2017 (Exhibit 2). Credit restriction on developers’ end discouraged nationwide financing activities as well as land banking. It prolonged the subsequent constructions and sales. Yet leading names with strong financing capabilities were relatively less affected. On the contrary, they could benefit from cheap land during down cycles and gain market share with adequate offerings when spring came.

Although the market concentration has sharply increased, constituents of the top 20 has remained unchanged in the last decade. We have seen that only 11 out of top 20 developers remained in the sales league. The number is 6 for top 10. If we look at those who fell behind, refinancing difficulties in tightening credit environments is usually the direct catalyst to failure. Stretched debt pushed new starts and construction delay, asset on-sale and even bankruptcy.

What drives consolidation?

A typical construction cycle spans across three to four years2 from land acquisition to the delivery of first phase units. In generally, takes six to nine months for developers to receive the first round of pre-sell proceeds, which means developers are running at a negative cash flow in the early stages of a project. Thus, raising additional funding plays an important role in the business model. Developers’ funding source mainly consists of four parts: domestic bank-borrowing takes a portion of 14.5% in 2018, off-shore debt financing of 0.1%, self-raised funds of 33.6%, homebuyers’ down payment and mortgage loan of 47.7% and others of 4.2%3. Developers generally devote only one-third of total investment. The business scale highly relies on credit and pre-sale policies across cities.

China’s housing market experienced three phases since the housing market reform in 1998. The first phase was the land dividend stage prior to 2002 when land allocations were done by the state, with no market mechanisms involved. Anyone who could attain land definitely came out as a winner. Land market auction mechanisms were introduced in 2002. After that, China’s real estate industry took off, coupled with a fast-growing capital market. Publicly-listed developers fully utilized capital dividend to scale up their business till 2016; this was when China’s central government first emphasized “housing for living, not for speculation”. It is the financing capabilities that drove the high-paced coarse growth and moderate market share increases in the second phase. During the period, floor area per capita increased to over 304 square meters in China, quite close to the level in most developed countries. Nationwide adequate supply and continuous tightening of policies imposed new requirements on developers in the next phase, despite demand from upgrading and further urbanization existing across regions. It could be as a result of comprehensive competition in financing, land bank quality and geographical split, as well as land costs and housing price balance, product as well as sales channels. The recent new financing rules of “three red lines” further restricted the financing scale. Some developers could not add new debt in the near future. They even have to sell assets to accelerate cash collection and lower their debt levels. It resulted in a near term industry wide deceleration and may consequently help with consolidation from a medium term perspective.

What are the implications of the consolidation trend to investors?

Real estate is essentially a financial business which requires capability of financing, investment, product development and sales. Property developers are able to increase the rate of return by leverage though gross margins of each project or when overall net margins are low. However, the other side of the coin is when leverage becomes a major source of risk. When the economy is going well and demand is strong, the requirements on product and sales are low. Leverage is helpful in revenue augment. As the industry becomes mature and more competitive, the right products and promotions, accurate rate of return calculation in land investment, solid financing capabilities, are all needed for sustainable success. We can see in Exhibit 2 that the concentration of the top 10 developers in tier 1/2 cities in China is still relatively low compared with other countries. The market expansion pace may slow down thanks to the new financing rules, but won’t stop from a longer-term perspective. We believe the rate of return considering leverage to developers should not be too much higher than other mature industries in the long term. This will ultimately prevent new entrants and end consolidation.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.