THIS MATERIAL IS A MARKETING COMMUNICATION.

Demand For Education in China Remains Strong

Why the demand for education in China remains strong?

• Rapid economic growth is underpinning a desire for better education

•Parents are willing to invest heavily in their children’s future

•The one-child policy is now a choice rather than an obligation

•High-value-added industries require better skills

Demand for education, particularly K12 After School Tutoring (AST), remains robust in China. The country’s rapid economic growth has led to improvements in the education levels of many parents, who, in turn, believe that entering a good university will change their children’s lives. In other words, many parents see education as an investment rather than an expense.

EXHIBIT 1. HIGHLY INTENSIVE COMPETITION FOR TOP UNIVERSITIES IN CHINA

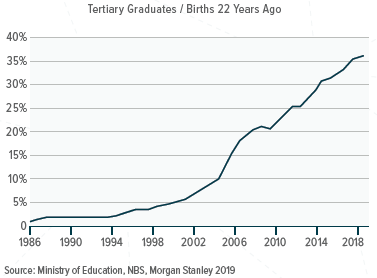

EXHIBIT 2. EDUCATION LEVEL IS IN FAST IMPROVING TREND

EXHIBIT 3. CHINA AST K12 MARKET SIZE BASED ON REVENUE

SPEND RATHER THAN SAVE

Education is now more affordable thanks to rising incomes and better social welfare. Money that may have been saved by previous generations can now be released. Indeed, education-related costs are one of the last things parents cut if they need to trim their discretionary spending.

EXHIBIT 4. K12 AST PENETRATION IN CHINA

EXHIBIT 5. K12 AST PENETRATION BASED ON STUDENT ENROLLMENT

ONE CHILD, BY CHOICE

The Chinese government has relaxed its one-child policy and now allows families to have two children (if one parent was an only child in 2013). For financial reasons, however, many couples choose to have only one child – a trend being mirrored in other developed countries. These so-called ‘little emperors’ are not only supported by two parents but also four grandparents. This may be another reason why so many parents are willing to invest so much in education – they only have one opportunity.

HEADING TO THE CITY

According to Morgan Stanley, the urbanization ratio reached 60% in 2018 (from 20% in 1978), and is expected to touch 75% by 2030. By that stage, there will be 220 million urban dwellers. That said, junior education is already inadequate in many big cities, and there will be strong demand for K12 AST going forward.

LOW TO HIGH VALUE

Finally, China is upgrading its core industries with a move to high-value-added areas, such as technology. The country has long been the world’s factory, but with rising labor costs, even more so with the recent trade war, the low-value sectors (for example, textiles) are shifting their manufacturing bases to other countries (Vietnam, India and others in South East Asia). At the same time, the government is supporting strategic high-value-added industries, such as electric vehicles, 5G, and semiconductors, with its Made in China 2025 target. This works both ways: the state needs highly educated people, while at the same time, it has to provide job opportunities for them. In a way, we can say that learning is paying off because when there are good jobs for highly qualified people, it then underpins the demand for education.

EXHIBIT 6. CHINA’S NUMBER OF NEW GRADUATES PER YEAR FAR EXCEEDS THAT OF KEY DEVELOPED COUNTRIES

EXHIBIT 7. MORE AND MORE YOUNG PEOPLE ARE GRADUATING FROM COLLEGE

Related ETFs:

• Global X China Consumer Brand ETF (2806 HKD / 9806 USD)

Disclaimer

This document contains the opinions of Mirae Asset Global Investments (HK) Limited (“MAGIHK”) and is intended for your use only.

It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument and shall not constitute any form of regulated financial advice, legal, tax or other regulated service. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. MAGIHK makes no representation as to their accuracy or completeness and therefore do not accept any liability for a loss arising from the use of this document.

All Investments contain risks. Forecasts, past information and estimates have certain inherent limitations. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these opinions are suitable for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Past performance is not a guarantee or a reliable indicator of future results. Before making any investment decision, investors should read the applicable fund prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the applicable investment and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice if in doubt.

This document is issued by MAGIHK (Licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance). This document has not been reviewed by the Securities and Futures Commission and no part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of MAGI HK.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.