THIS MATERIAL IS A MARKETING COMMUNICATION.

Asia Semiconductor Industry Review

Secular Change – TSMC stretching the lead in advance node

It is increasingly difficult to keep up with Moore’s Law. TSMC’s node migration cadence is extending beyond two years and is even longer for its competitors. TSMC continues to extend its lead in advanced node manufacturing with strong execution in yield improvement, ramp-up of new nodes, and better node performance metrics.

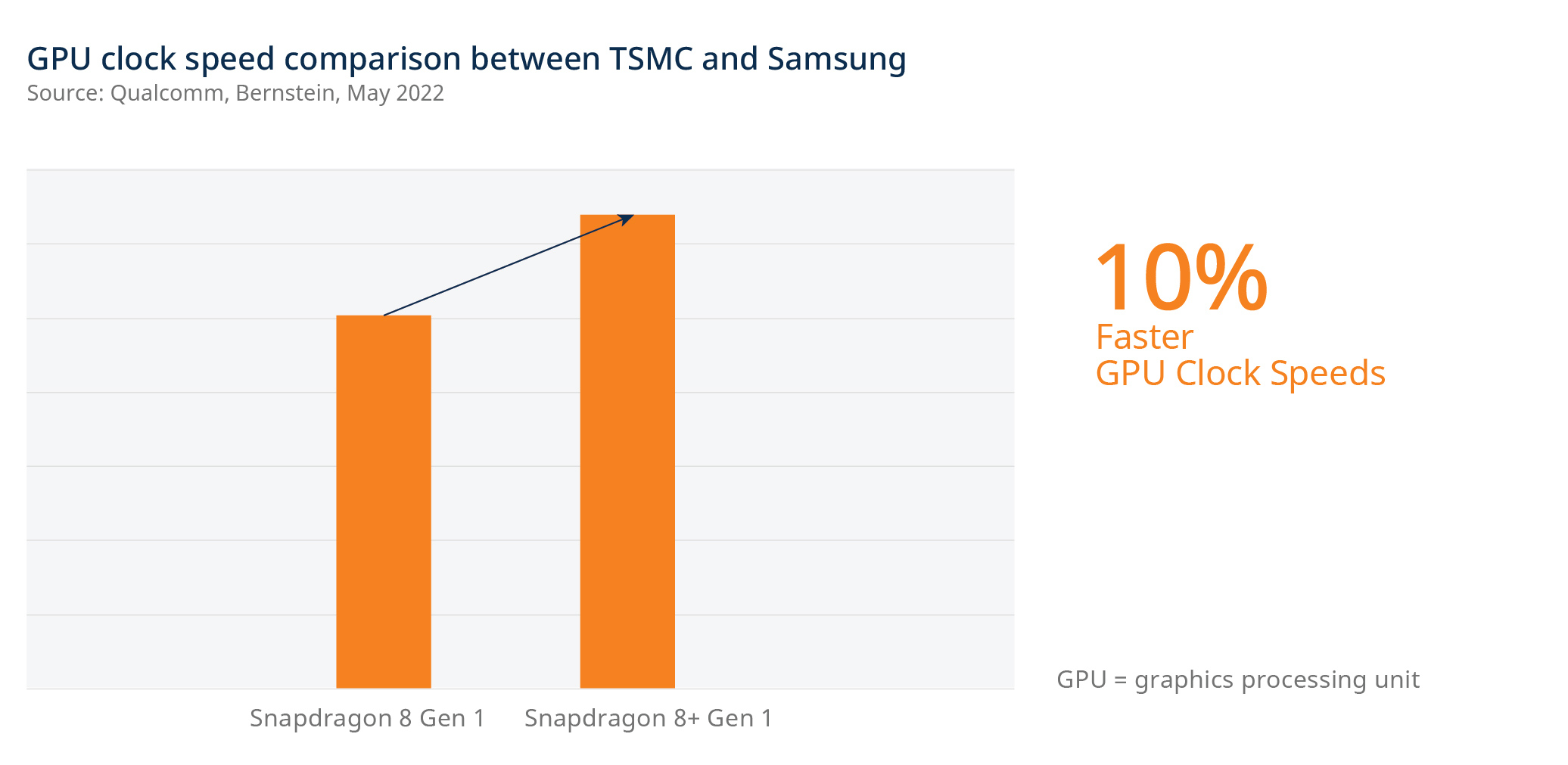

While TSMC and Samsung ramp their respective 4nm node on a similar schedule, Samsung incurs yield issues and weaker performance metrics. As a result, the Qualcomm Snapdragon 8 Gen 1 made by Samsung suffers overheating and high power consumption problems. Qualcomm shifted orders for the new Snapdragon 8 Gen 1+ to TSMC’s 4nm node, which improved the GPU (graphics processing unit) clock speed by 10% and showed up to 30% more power efficiency on the same performance.1

We see a steady market share gain trend for TSMC. NVIDIA allocated ~90% of its chip production to Samsung in the 7/8nm generation but, starting early this year, is moving more capacity to TSMC.2 This includes most of its GPUs and Arm-based Grace CPUs (central processing units), which are moving to TSMC’s 5nm. Apple and AMD’s CPU market share gain leveraging TSMC’s 4/5nm process is an indirect share gain from Intel.

In terms of transistor density, TSMC is already ahead of Samsung and Intel on the current roadmap. More importantly, while Samsung and Intel’s roadmap timeline looks similar to TSMC’s, they continue to fall behind on actual progress. Intel is expected to see a delay in the launch of its new server chip, Sapphire Rapids, at the end of this year, which is based on Intel 7.3 Samsung has limited external customers on its 3nm GAA (gate-all-around) node (similar transistor density to TSMC’s N4) and still struggles with 4nm.4 On the other hand, TSMC is on track to mass-produce N3 later this year, and its yield on N4 has also been stable.5

Secular Change – Autonomous driving EV penetration drives auto semiconductor market expansion

Electrification of automobiles is an unstoppable trend. The semiconductor industry is well-positioned to support this transition and benefit from a significant increase in its total addressable market (TAM). A typical electric vehicle (EV) has twice as much semiconductor content as an internal combustion engine car, at around USD$800 per vehicle.6 A large portion of the incremental content comes from power semiconductors. The BOM (bill of materials) for a full self-driving car can be even higher when using silicon for self-driving computers. Rapid EV adoption is expected to drive the power semiconductor market to grow from USD$7 billion in 2020 to USD$24 billion by 2030.7 The automotive microcontroller (MCU) market is projected to reach over USD$12 billion by 2025, from USD$7.6 billion in 2021.8 Key suppliers include NXP, Renesas, Infineon, and Texas Instruments.

The development of higher-level self-driving vehicles has also driven the demand for high-performance systems-on-a-chip (SoC) to support new architectures and process input from an array of sensors. The SoC enables autonomous vehicles’ perception, planning, control, and more. Mobileye estimates that the TAM for ADAS (Advanced driver-assistance systems) related silicon will reach USD$4.5-6 billion in the next few years.9 The ADAS market will also be significantly larger once L4 and L5 vehicle10 penetration increases, given the ASP (average selling price) for a full self-driving SoC can be anywhere from USD$500 to over USD$1000.11

Sector Update – Cyclical concern due to high inventory

Across the industry, we see elevated inventory levels compared to history, except for analog, MCU, FPGA (field-programmable gate array), and auto-related power chips. In the near term, we see a higher risk of inventory correction for the sector, considering the challenging global macro environment and cyclicality of the industry. Semiconductor inventory increased 10 days quarter-on-quarter (QoQ), to 95 days in 1Q22, above the 85-day 1Q average since 2019 and the 77-day median over the past decade.12 Global fabless inventory was also up 10 days QoQ to 102 now, above the high end of its 67-99 day range, mainly due to still aggressive wafer procurement and slower consumer demand.13 IDM (integrated device manufacturer) inventory ex-Intel was also up 18 days QoQ, to 122 exiting 1Q22, and now in the upper half of its 90-130 day 10-year range.14

1. Source: Bernstein, Qualcomm, May 2022

2. Source: Morgan Stanley, May 2022

3. Source: Mirae Asset, June 2022

4. Source: Mirae Asset, June 2022

5. Source: Mirae Asset, June 2022

6. Source: Mirae Asset, 2022

7. Source: Credit Suisse, 2021

8. Source: IC Insights, 2021

9. Source: Mobileye, 2021

10. L4 vehicles are highly automated with human override option available; L5 vehicles are fully automated with zero human attention or interaction required

11. Source: Mobileye, 2021

12. Source: Credit Suisse, 2021

13. Source: Credit Suisse, 2021

14. Source: Credit Suisse, 2021

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KI(I)Ds”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KI(I)Ds can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KI(I)Ds are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KI(I)D before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary/.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Hong Kong: It is intended is for Hong Kong investors. Before making any investment decision to invest in the Fund, Investors should read the Fund’s Prospectus and the information for Hong Kong investors (of applicable) of the Fund for details and the risk factors. The individual and Mirae Asset Global Investments (Hong Kong) Limited may hold the individual securities mentioned. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Singapore: It is not intended for general public distribution. The investment is designed for Institutional investors and/or Accredited Investors as defined under the Securities and Futures Act of Singapore. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Monetary Authority of Singapore. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Swiss investors: This document is intended for Professional Investors only. This is an advertising document. The Swiss Representative is 1741 Fund Solutions AG, Burggraben 16, CH-9000 St. Gallen. The Swiss Paying Agent is Tellco AG, Bahnhofstrasse 4, CH-6431 Schwyz. The Prospectus and the Supplements of the Funds, the KI(I)Ds, the Memorandum and Articles of Association as well as the annual and interim reports of the Company are available free of charge from the Swiss Representative.

UK investors: This document is intended for Professional Investors only. The Company is a Luxembourg registered UCITS, recognised in the UK under section 264 of the Financial Services and Markets Act 2000. Compensation from the UK Financial Services Compensation Scheme will not be available in respect of the Fund. The taxation position affecting UK investors is outlined in the Prospectus.

Copyright 2025. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.